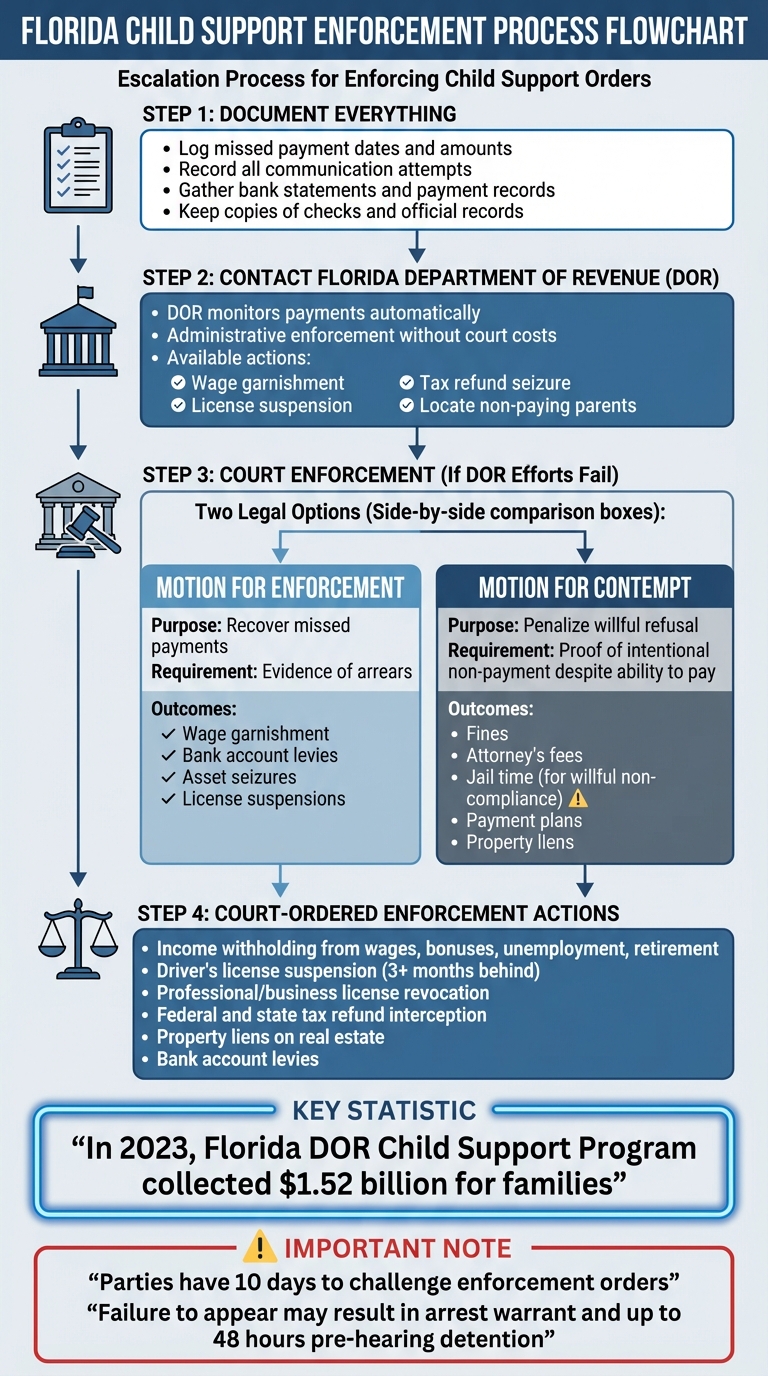

When a parent fails to pay child support in Florida, the state uses administrative and court-based methods to ensure compliance. The Florida Department of Revenue (DOR) handles most cases through wage garnishment, license suspensions, and tax refund seizures. If these efforts fail, courts can step in with motions for enforcement or contempt, leading to actions like bank account levies, property liens, or even jail time for willful non-payment. Custodial parents should keep detailed records of missed payments and act promptly to address issues. Legal assistance can simplify navigating these processes.

Florida Child Support Enforcement Process: From Administrative Actions to Court Remedies

First Steps to Enforce a Child Support Order

Custodial parents often have options to address payment issues without immediately turning to the courts. The Florida Department of Revenue (DOR) offers administrative tools that can help enforce child support orders efficiently, provided the custodial parent acts promptly and maintains accurate records.

Keeping Records of Missed Payments

Detailed documentation is the backbone of enforcement efforts. Custodial parents should log every missed payment, noting the exact dates, amounts owed, and any partial payments received. Additionally, keep a record of all communication attempts with the non-paying parent, including text messages, emails, phone call details, and written correspondence.

Supporting evidence such as bank statements, copies of checks, and official payment records from the Child Support Disbursement Unit is also crucial. The type of evidence needed may vary depending on the payment method – whether payments are made via direct deposit, personal checks, or through Florida’s state payment system.

Once your records are in order, reach out to the DOR to initiate enforcement without delay.

Working with the Florida Department of Revenue

If your case is already active with the DOR, they will monitor payments and take enforcement actions as needed. For those without an open case, the first step is to establish one with the DOR to gain access to their enforcement services.

The DOR has the authority to enforce support orders through measures like wage garnishment and license suspension without requiring a new court order. In 12 specific counties – Broward, Desoto, Hillsborough, Pasco, Pinellas, Sarasota, Franklin, Gadsden, Jefferson, Leon, Liberty, and Wakulla – the Child Support Enforcement Bureau (CSE) of the Attorney General’s Office works alongside the DOR to handle legal proceedings.

"The Department of Revenue can initiate enforcement without high legal costs. Don’t wait until arrears accumulate significantly." – The McKinney Law Group

Acting early is key. The DOR can locate non-paying parents, issue income withholding orders, and, when necessary, escalate the matter by filing Motions for Contempt in court if administrative efforts fall short. Early intervention helps prevent arrears from becoming overwhelming.

Court Remedies for Child Support Enforcement

When efforts by the Department of Revenue (DOR) fall short, Florida courts offer additional legal options to enforce child support orders. Custodial parents can turn to the courts by filing either a Motion for Enforcement or a Motion for Contempt. Each serves a specific purpose and comes with distinct legal outcomes.

How to File a Motion for Enforcement

A Motion for Enforcement is designed to recover overdue child support through court-mandated actions. To start, you’ll need to file an enforcement action with the circuit court clerk. The case is then assigned to a support enforcement hearing officer, who can issue legal processes, administer oaths, and request documents.

The hearing officer will schedule a hearing, take testimony, and provide a recommended order for the court to review. Unless there’s a valid reason to modify or revisit the case, the court will finalize the order. Parties involved have 10 days to challenge or vacate the order.

Before filing, it’s essential to gather key documents, including the original support order, any modifications, payment records, and evidence of previous collection attempts. Remedies available through this motion include wage garnishment, bank account levies, asset seizures, and even license suspensions.

How to File a Motion for Contempt

While similar to enforcement actions, a Motion for Contempt focuses on holding the non-paying parent accountable for willful non-compliance. To initiate, you must file a motion that details the alleged contempt. The non-paying parent must then receive notice of the hearing, which includes this warning:

"Failure to appear may prompt a writ of bodily attachment and up to 48 hours of pre-hearing detention." (Florida Rules of Civil Procedure, Rule 12.615(b))

At the hearing, you’ll need to prove three critical elements: that a court order for payment exists, that the parent failed to comply with that order, and that the parent had the financial means to pay but deliberately chose not to. If the accused parent doesn’t appear, the court may set a purge amount and issue a writ of bodily attachment for their arrest.

If the court determines contempt, it will issue a written order outlining specific findings and conditions for purging the contempt. Consequences can include fines, attorneys’ fees and court costs, and even jail time if deemed necessary. Additional measures may include income withholding, payment plans, seizing tax refunds or lottery winnings, property liens, and license revocations.

Motion for Enforcement vs. Motion for Contempt

| Feature | Motion for Enforcement | Motion for Contempt |

|---|---|---|

| Primary Purpose | Recover missed payments | Penalize willful refusal to pay and enforce compliance |

| Key Requirement | Evidence of missed payments or arrears | Proof that the non-paying parent intentionally avoided payment despite having the ability to pay |

| Possible Outcomes | Wage garnishment, license suspension, tax refund interception, property liens | Fines, attorneys’ fees, jail time (only for willful non-compliance) |

| When to Use | When payments are overdue and administrative efforts haven’t worked | When the non-paying parent refuses to comply after other measures fail |

The main distinction lies in the concept of willfulness. Motions for Enforcement aim to recover unpaid support, while Motions for Contempt require proof that the non-paying parent deliberately avoided their financial responsibilities despite having the means to meet them.

sbb-itb-bb7ced0

Enforcement Actions Florida Courts Can Order

When a Florida court determines that child support enforcement is necessary, it has several tools to ensure compliance. These measures range from garnishing wages to seizing assets, all aimed at recovering overdue payments. Here’s a closer look at the most common enforcement actions used in Florida.

Wage Garnishment and Income Withholding

Wage garnishment is one of the most effective methods for collecting unpaid child support in Florida. Courts can require employers to automatically deduct child support payments directly from the non-paying parent’s paycheck. This ensures payments are made consistently and on time, minimizing the risk of missed or partial payments.

The process doesn’t stop at regular wages. Courts can also withhold funds from bonuses, unemployment benefits, and even retirement income. Once an employer receives an Income Withholding Order (IWO), the deducted funds are sent to the custodial parent through the State Disbursement Unit. The Florida Department of Revenue can often initiate this process without needing a new court hearing.

License Suspension and Passport Restrictions

Florida courts can suspend various licenses to enforce child support orders. If a parent is behind on payments for three months or more, their driver’s license can be suspended. Other licenses, such as professional, business, or occupational permits, can also be revoked. Losing these licenses can significantly impact a person’s ability to work and meet their obligations. The Florida Department of Revenue frequently uses this as an administrative enforcement tool.

Tax Refund Seizure and Property Liens

Another powerful enforcement method involves seizing assets and placing liens on property. Federal and state tax refunds are often intercepted to cover unpaid child support. Similarly, windfalls like lottery winnings or insurance settlements can also be redirected to pay off arrears.

Courts can place liens on real property owned by the non-paying parent. Once a judgment for delinquency is issued, it automatically becomes a lien against any real estate they own. In addition, courts can order bank account levies, freezing and seizing funds to cover unpaid support. These actions are especially effective when other enforcement methods fall short. For example, in 2023, the Florida Department of Revenue Child Support Program collected $1.52 billion for families[1].

Conclusion: Obtaining Legal Assistance with Child Support Enforcement

Key Points About Child Support Enforcement

Florida courts rely on a mix of administrative and judicial tools to ensure child support orders are followed. For instance, wage garnishment directly deducts support payments from a parent’s paycheck. In many cases, the Florida Department of Revenue can handle these actions administratively, without the need for a court hearing. Knowing these enforcement options can help custodial parents decide the best course of action for their unique situation. However, when these measures fall short, seeking guidance from an experienced attorney becomes crucial.

How Law Firm Ocala Can Help You

Dealing with child support enforcement can be overwhelming, especially in complicated scenarios involving large unpaid balances, concealed income, or hidden assets. This is where professional legal assistance can make a real difference. An attorney can file motions for contempt, address interstate enforcement challenges, and ensure accurate calculations of penalties and interest.

"You are not required to hire a lawyer, but it is recommended to obtain a lawyer to assist. The judge can even require the other party to pay your attorney’s fees, as a sanction for their failure to comply with the court order." – Florida Law Advisers, P.A.

Law Firm Ocala focuses on family law matters, including child support enforcement. They offer a free initial consultation to review your case and discuss your legal options. Their team of experienced attorneys is dedicated to protecting your rights and resolving enforcement issues efficiently. If the other parent is failing to comply with a court order, consulting with Law Firm Ocala can help you take the necessary steps to secure the support your child is entitled to.

FAQs

What can I do if Florida’s child support enforcement methods aren’t working?

If the Florida Department of Revenue (DOR) has already tried enforcement methods – like wage garnishment, license suspension, or intercepting tax refunds – and you’re still not receiving the court-ordered child support, it may be time to take legal action yourself. Start by gathering all the necessary documents, including DOR notices, payment records, and any evidence showing the other parent’s non-compliance. Once you have everything in order, file a Motion for Civil Contempt with the circuit court that issued the original support order. This motion should detail how the non-paying parent has failed to meet their obligations. It must also be notarized and served to the other party, usually through a sheriff or professional process server.

After filing, the court will set a hearing date. A Child Support Enforcement Hearing Officer will review the case, and the non-paying parent will have the opportunity to present a defense – such as proving an inability to pay. If the court determines they are in contempt, penalties can include fines, jail time, or even additional wage garnishment to enforce compliance.

If you’re feeling uncertain about how to navigate this process or if the situation becomes complicated, reaching out to a family law attorney can be a smart move. A firm like Law Firm Ocala can help with everything from filing paperwork to representing you in court, ensuring stronger enforcement of the support order and safeguarding your child’s financial security.

How do I prove someone is intentionally not paying child support in Florida?

To prove that someone intentionally failed to pay child support in Florida, you need to demonstrate that they willfully ignored a valid court order – not just that they were unable to pay. Start by presenting the court order that outlines the payment amount and schedule. Then, show evidence that the person knew about the order and deliberately chose not to follow it.

Here are some key types of evidence to support your case:

- Payment records: Highlight missed or incomplete payments.

- Correspondence: Emails, texts, or letters where the obligation was addressed or reminders were sent.

- Proof of financial ability: Documents like pay stubs or bank statements that indicate they had the means to pay but chose not to.

After you present your evidence, the court will give the other party a chance to explain any genuine financial difficulties. If they fail to provide a valid reason, the judge may impose penalties, which could include fines, covering attorney fees, or even jail time for deliberate non-compliance. Strong documentation is the foundation of a solid case.

What types of licenses can be suspended if child support isn’t paid in Florida?

In Florida, falling behind on child support payments can lead to the suspension of several types of licenses. While a driver’s license is the most commonly affected, professional, recreational, and even business licenses can also be at stake. These penalties aim to prompt compliance with child support responsibilities.

If you’re dealing with a potential license suspension due to unpaid child support, it’s crucial to address the situation promptly. Courts may provide solutions like payment plans or alternative arrangements to help you catch up. Seeking advice from a skilled family law attorney can guide you through the process and ensure your rights are safeguarded.