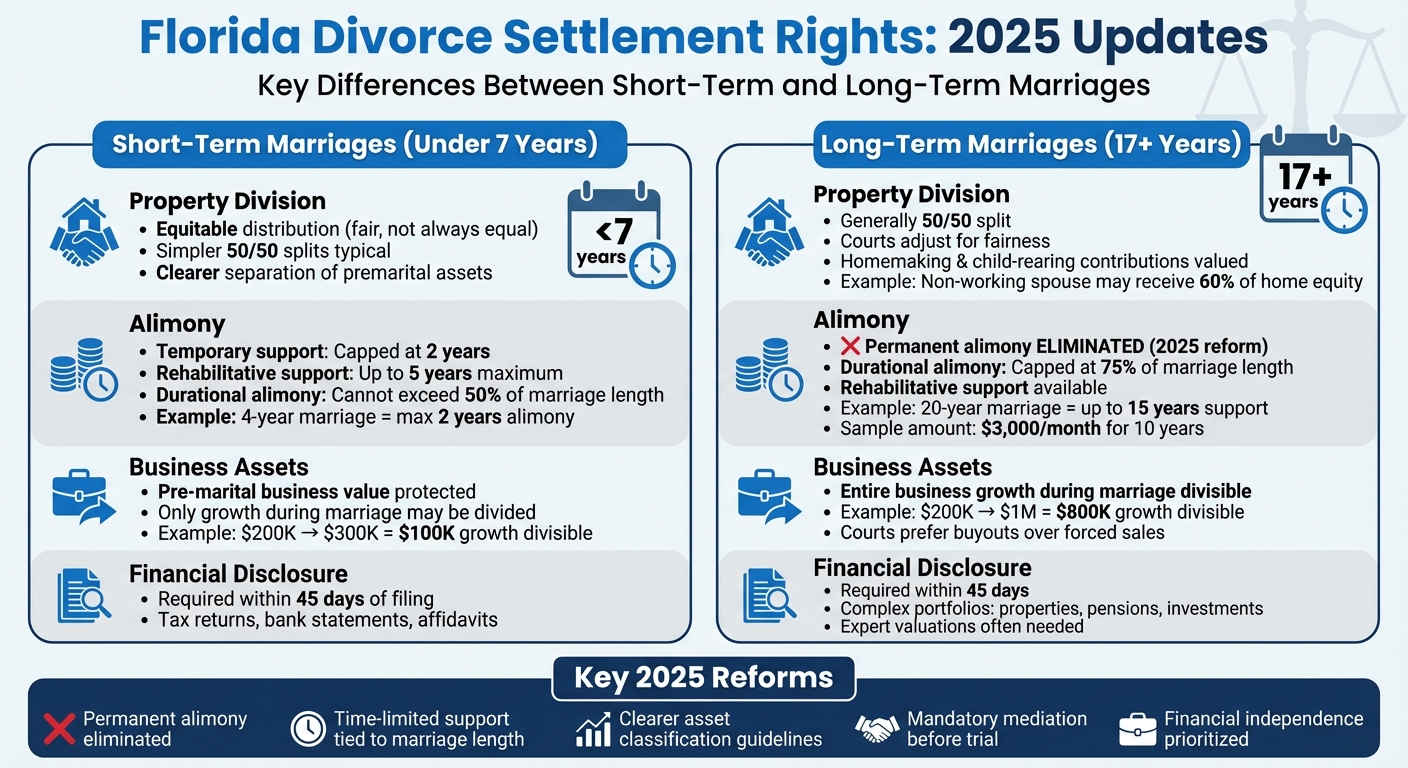

Florida’s divorce laws saw major updates in 2025, especially regarding alimony and property division. Here’s what you need to know:

- Alimony Changes: Permanent alimony is eliminated. Support is now time-limited, tied to marriage length, and capped at 75% of the marriage duration for long-term unions.

- Asset Division: Florida follows equitable distribution, meaning assets and debts are divided fairly, not always equally. Factors like marriage length, contributions, and future needs affect this.

- Inheritance & Business Assets: Inheritances and pre-marital business assets are protected unless commingled with marital funds. Growth during marriage may still be divided.

- Financial Disclosures: Full financial transparency is required within 45 days of filing, including affidavits, tax returns, and account statements.

Short-term marriages (under 7 years) usually involve simpler asset division and limited alimony, while long-term marriages (17+ years) demand more complex settlements. The 2025 reforms prioritize financial independence and clarity in divorce proceedings. Early preparation and legal guidance are essential for a fair outcome.

Florida Divorce Settlement Rights: Short-Term vs Long-Term Marriages Comparison 2025

1. Divorce Settlement Rights in Short-Term Marriages

Property Division

In Florida, divorces involving marriages lasting less than seven years are governed by equitable distribution laws as outlined in Fla. Stat. §61.075. This means marital property is divided in a way that’s fair, though not always equal. The length of the marriage plays a big role here – shorter marriages typically lack the deep economic ties seen in longer unions. For instance, if a couple purchased a home during a 5-year marriage, the court might order the property sold and the proceeds split evenly, while also accounting for any non-marital contributions. This approach to dividing property lays the groundwork for how other financial matters, like alimony, are handled.

Alimony Rights

Florida’s 2025 alimony reforms have tightened the rules for short-term marriages. For unions lasting less than seven years, alimony is limited to temporary or rehabilitative support, capped at a maximum of five years. Durational alimony, if awarded, cannot exceed half the length of the marriage. For example, in a 4-year marriage where one spouse earns $30,000 annually and the other earns significantly more, the lower-earning spouse might receive $1,000 per month for 1–2 years to help them regain financial independence. Courts prioritize immediate financial needs, emphasizing a quick path to self-sufficiency. These changes reflect a shift away from long-term dependency and place a greater focus on financial independence.

Business Assets and Inheritance

When it comes to inheritance and business assets, Florida law provides clear protections. Inherited assets remain solely yours unless they are commingled with marital funds, such as depositing inheritance money into a joint account. Similarly, businesses owned before marriage are considered separate property, but any increase in value during the marriage may be subject to division. For example, if a business valued at $200,000 before the marriage grows to $300,000 over five years, only the $100,000 increase might be divided – especially if the other spouse contributed to its growth. The 2025 reforms reinforce these protections, but keeping thorough records to distinguish pre-marital assets from marital gains is crucial.

Financial Disclosure

Accurate financial records are critical during settlement negotiations. Florida law mandates full financial disclosure within 45 days of filing for divorce under Rule 12.285. This includes affidavits, tax returns for the past year, and bank and retirement account statements. Failing to provide complete information can lead to penalties, such as income being imputed or assets being divided unfavorably. Even in short-term marriages with fewer assets, transparency ensures both parties have a clear picture of what’s at stake. For instance, hiding a $10,000 transfer before filing could result in court scrutiny and an unequal division of assets. Honesty and detailed records are key to protecting your rights.

2. Divorce Settlement Rights in Long-Term Marriages

Property Division

In Florida, marriages lasting 17 years or more are classified as long-term, which plays a key role in how assets are divided. Under the state’s equitable distribution laws, marital property is generally split 50/50, but courts can adjust this based on fairness. In long-term marriages, contributions like homemaking, child-rearing, or career sacrifices carry significant weight. For instance, a non-working spouse in a 20-year marriage might be awarded 60% of the marital home equity to reflect these contributions. The 2025 updates have introduced clearer guidelines for valuing different types of assets. Judges also prioritize ensuring the lower-earning spouse can maintain a lifestyle similar to what they enjoyed during the marriage, which influences how property and assets are divided.

Alimony Rights

Long-term marriages require a deeper evaluation of financial support due to years of shared finances. The 2025 legal updates eliminated permanent alimony, even in these cases. Instead, courts now award durational alimony, which is capped at the length of the marriage, rehabilitative support to help a spouse gain skills, or temporary assistance during the divorce process. For example, in a 20-year marriage where one spouse earns $150,000 annually and the other earns $40,000, the lower-earning spouse might receive $3,000 per month in durational alimony for up to 10 years. While the focus has shifted toward encouraging financial independence, long-term marriages still qualify for the longest possible support periods. Stricter guidelines introduced in 2025 aim to reduce disputes and simplify settlement negotiations.

Business Assets and Inheritance

Business interests and inheritances can complicate asset division in long-term marriages. Businesses started or significantly grown during the marriage are considered marital property. For example, if a business was worth $200,000 before the marriage and grows to $1,000,000 over 20 years, the $800,000 growth is typically divided equitably. Courts generally avoid forcing the sale of a business, opting instead for buyouts or offsets using other assets like retirement funds. Inheritances, on the other hand, are treated as non-marital property if kept separate. However, if an inheritance is commingled with marital funds – like depositing a $500,000 inheritance into a joint account and using it for shared expenses over 17 years – it may become partially divisible. The 2025 updates introduced clearer rules for tracing assets, but keeping detailed records is crucial to protect separate property.

Financial Disclosure

In long-term marriages with complex assets, full financial disclosure is critical. Both parties are required to provide complete documentation within 45 days, including affidavits, tax returns, bank statements, retirement account details, and business records. This level of transparency is essential for avoiding disputes over hidden assets and ensuring a fair division. Long-term marriages often involve intricate portfolios with multiple properties, pensions, and investments, making expert valuations and thorough documentation indispensable. Mediation is mandatory before trial in most Florida divorces, and many long-term cases are resolved during mediation. Consulting experienced family law attorneys, such as those at Law Firm Ocala, ensures your rights are protected throughout the process.

sbb-itb-bb7ced0

Advantages and Disadvantages

Building on the legal rights discussed earlier, let’s dive into how Florida’s divorce laws impact short-term and long-term marriages. With the 2025 reforms in place, here’s a breakdown of the key benefits and challenges for each marriage type.

Short-term marriages (typically less than 10 years) often lead to quicker financial independence. With fewer shared assets and clearer premarital records, dividing property is more straightforward. Alimony in these cases is limited – temporary support is capped at 2 years, and durational alimony rarely extends beyond 5 years. While this shorter timeframe can make for a cleaner break, it may leave lower-earning spouses with insufficient support to rebuild their careers or financial standing. For instance, a spouse might receive only 3 years of support, which may not be enough to regain stability.

Long-term marriages (17 years or more) provide more financial security to the lower-earning spouse. Courts may award durational alimony lasting up to 75% of the marriage length, offering significant time to adjust financially. Additionally, non-financial contributions, such as raising children or managing the home, are often considered during asset division. This can result in a more equitable split than the typical 50/50. However, these divorces tend to be more complex and costly. Dividing retirement accounts, real estate, and businesses accumulated over decades often requires expert valuations and lengthy negotiations. For higher-earning spouses, this can mean extended financial obligations and a larger portion of business growth subject to division.

| Aspect | Short-Term Marriages | Long-Term Marriages |

|---|---|---|

| Equitable Distribution | Advantage: Simpler 50/50 splits with clearer separation of premarital assets Disadvantage: Less room to argue for adjustments based on contributions |

Advantage: Courts adjust for disparities and recognize homemaker contributions Disadvantage: More assets become marital, enlarging what gets divided |

| Alimony Duration | Advantage: Limited alimony duration (temporary support capped at 2 years; durational rarely exceeds 5 years) Disadvantage: Insufficient support for career rebuilding |

Advantage: Extended support (up to 75% of marriage length) Disadvantage: Prolonged financial ties between ex-spouses |

| Business Assets | Advantage: Limited claims on premarital business value Disadvantage: Less leverage in negotiations |

Advantage: Greater claim on business growth during marriage Disadvantage: Complex valuations may force sale or debt |

When dividing business assets, the length of the marriage plays a significant role. For example, in a 5-year marriage, a spouse might claim 30% of the business growth, leaving the majority of the value with the owner. In contrast, a 25-year marriage could see the entire appreciation of the business treated as marital property. While this ensures fairer compensation for contributions, it can disrupt business operations, potentially requiring a buyout or asset offset.

Navigating these complexities requires a skilled approach. Whether you’re aiming to protect premarital assets in a short-term divorce or maximize your share in a long-term settlement, experienced family law attorneys at Law Firm Ocala can help you make informed decisions and achieve the best outcome for your situation.

Conclusion

Florida’s 2025 divorce reforms introduce tailored approaches for both short- and long-term marriages. For marriages lasting less than seven years, the process focuses on straightforward asset division and temporary alimony arrangements. On the other hand, divorces from unions exceeding 17 years involve more intricate property distribution and durational alimony with specific time limits. Notably, permanent alimony is no longer an option, emphasizing the goal of financial independence for both parties within a defined period.

These reforms also bring stricter rules for financial disclosures and asset classification, particularly when dividing retirement accounts, cryptocurrencies, and business assets. This added complexity makes expert legal guidance more important than ever. Preparing early and understanding these updated guidelines can significantly impact the outcome of your case.

Whether your situation involves a brief marriage with few shared assets or a decades-long union with substantial holdings, having a sound legal strategy is key to protecting your financial interests. Florida’s mandatory mediation and binding final judgments further highlight the importance of working with experienced legal professionals who can guide you through these updated procedures.

For personalized assistance with Florida’s divorce settlement laws, reach out to Law Firm Ocala at (352) 390-2693 or visit their office at 110 N. Magnolia Ave., Ocala, FL 34475. Their skilled family law attorneys are well-versed in the 2025 reforms and are ready to help you navigate both short-term and long-term cases effectively.

FAQs

What changes to alimony in short-term marriages are included in Florida’s 2025 divorce reforms?

Florida’s 2025 divorce reforms bring new updates to alimony rules, especially for short-term marriages. These adjustments could make it harder to qualify for alimony or reduce the chances of receiving it for marriages that lasted less than a year.

The intent behind these changes is to create alimony arrangements that are fair and tailored to the unique details of each case. If you’re going through a divorce, knowing how these updates might affect you can be crucial for planning your settlement discussions.

How are business assets and inheritances handled during a divorce in Florida?

In Florida, business assets and inheritances are usually treated as separate property if they were acquired before the marriage or received as an inheritance. But here’s the catch: if these assets are commingled with marital property – like depositing inherited money into a shared account or using business earnings for joint expenses – they could lose their separate status and become part of the division process during a divorce.

To safeguard these assets, it’s crucial to keep personal and marital property clearly separated. Consulting with a skilled family law attorney can provide guidance on your rights and help you create a plan to protect your assets during settlement discussions.

Why is financial disclosure important during divorce settlements in Florida?

In Florida divorce cases, financial disclosure plays a key role in ensuring clarity and fairness during settlements. By openly sharing details about assets, debts, and income, both parties can aim for a fair division of property and establish accurate terms for alimony or child support.

When financial information is incomplete or withheld, it can lead to unfair outcomes, such as hidden assets or income influencing the settlement inappropriately. This lack of transparency could result in disputes or even legal issues down the road. Sharing complete financial details not only safeguards your rights but also supports a balanced and equitable resolution for everyone involved.