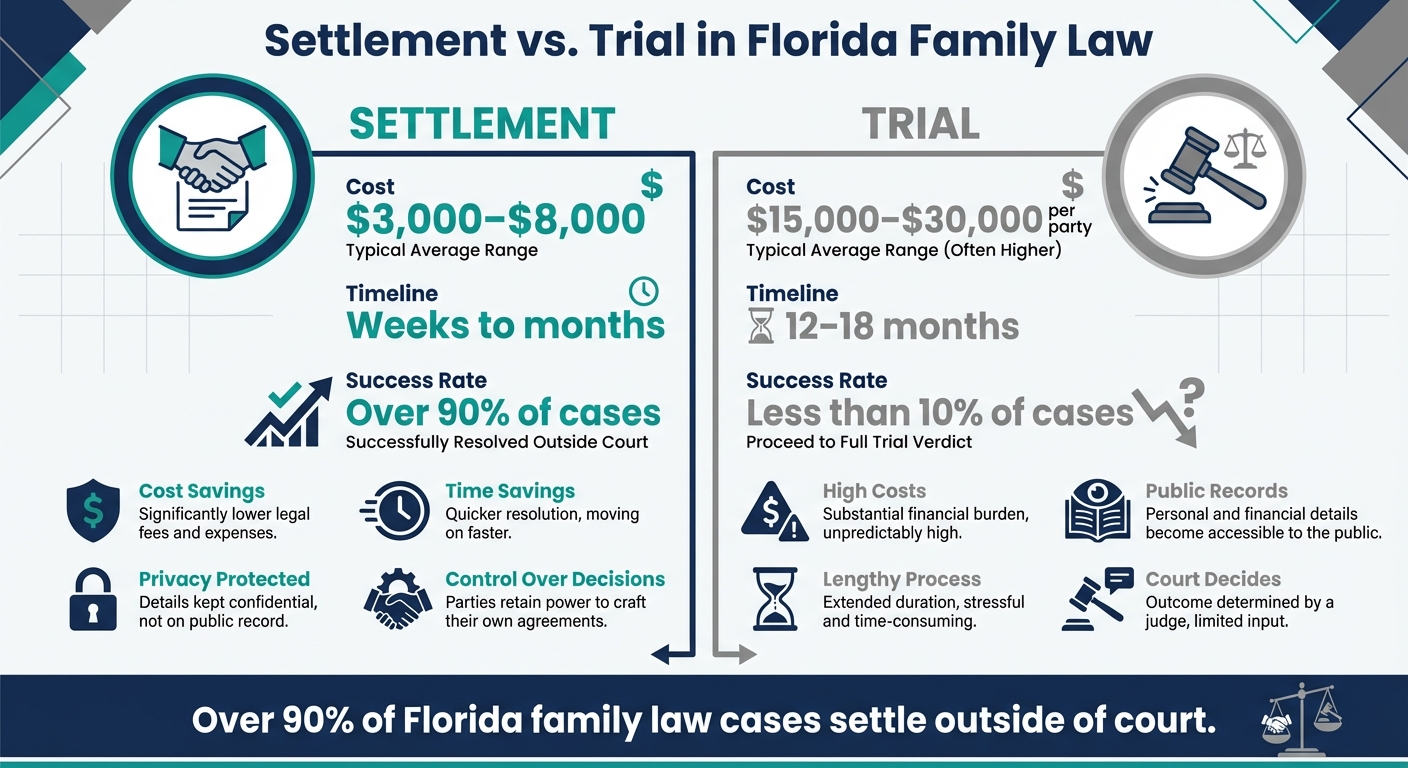

In Florida, resolving family law disputes like divorce, child custody, and asset division through settlements is faster, less expensive, and more private than going to trial. Settlements typically cost $3,000–$8,000 compared to $15,000–$30,000 per party for contested cases and are resolved in weeks or months instead of 12–18 months. Over 90% of cases settle outside court, allowing families to create tailored agreements that suit their needs.

Key points include:

- Cost and Time Savings: Settlements save thousands of dollars and significant time compared to courtroom trials.

- Control and Privacy: Families retain control over decisions and avoid public court records.

- Mediation: A mandatory step in Florida, mediation facilitates collaboration and agreement.

- Legal Framework: Florida’s rules on equitable distribution, child support, and parenting plans ensure fair, enforceable settlements.

- Parenting Plans: Detailed schedules and decision-making guidelines prioritize children’s best interests.

- Financial Security: Addressing alimony, retirement accounts, and insurance ensures long-term stability.

Family Law Settlement vs Trial: Cost and Time Comparison in Florida

Florida’s Legal Framework for Family Law Settlements

Florida law lays out clear rules for dividing property, determining support, and making parenting decisions. These guidelines shape the settlements that courts will uphold.

Equitable Distribution and Child Support Guidelines

In Florida, marital assets and debts are divided based on equitable distribution, as outlined in section 61.075 of the Florida Statutes. This doesn’t always mean a 50/50 split – it’s about what’s fair. Courts consider factors like the length of the marriage, each spouse’s financial situation, contributions to the household (including non-financial contributions like homemaking and childcare), and whether one spouse supported the other’s career or business growth. Marital property typically includes income earned during the marriage, retirement savings, jointly owned real estate, and shared debts. On the other hand, nonmarital property – such as assets owned before the marriage, inheritances, or individual gifts – usually stays with the original owner.

For child support, Florida uses a formula detailed in section 61.30. This calculation looks at both parents’ monthly net incomes, applies a statutory chart based on the number of children, and divides the financial obligation according to each parent’s income share. Additional factors include health insurance costs, daycare expenses, and how many overnights the children spend with each parent. When parenting time is significantly shared, adjustments to the support amount may apply, encouraging compromise by showing the financial effects of different timesharing arrangements.

Parenting decisions are guided by the “best interests of the child” standard, as explained in section 61.13. Courts evaluate factors like each parent’s ability to provide a stable home, meet the child’s emotional and physical needs, support their education, maintain routines, and foster a healthy relationship with the other parent. Judges also weigh any history of domestic violence or substance abuse. Every case involving children requires a parenting plan, which outlines schedules for weekdays, weekends, holidays, transportation, decision-making responsibilities (such as education and healthcare), and communication methods between parents. Once approved, these plans become binding court orders.

Mediation and Settlement Agreements

Given these legal guidelines, mediation often becomes the go-to method for resolving disputes. In fact, mediation is mandatory before trial in most Florida family law cases. After filing, the court typically orders both parties to attend mediation, which can be arranged through court programs or private mediators. During these sessions, a neutral mediator helps identify each party’s priorities, compares their positions to likely court outcomes, and explores potential agreements on property, support, and parenting matters. Mediation often involves a mix of joint discussions and private meetings, with the mediator ensuring that proposals align with Florida law.

If an agreement is reached, the mediator or attorneys draft a Marital Settlement Agreement and Parenting Plan for both parties to sign. These documents are then submitted to the court for approval. Judges review them to confirm that child support complies with guidelines and that parenting plans serve the child’s best interests. Once approved, these agreements are incorporated into the Final Judgment, giving them the same legal weight as any court order. If either party fails to comply, enforcement actions or contempt motions may follow. Modifications, however, require proof of a significant change in circumstances. Mediation communications are confidential, encouraging open and honest discussions that pave the way for workable solutions.

This legal framework sets the stage for effective negotiation strategies, which we’ll explore further in the next section.

Strategies for Successful Family Law Settlements

Navigating family law settlements in Florida requires careful planning, a clear understanding of priorities, and the ability to manage emotions effectively. By focusing on preparation, interest-based negotiation, and emotional control, you can work toward a settlement that meets your family’s unique needs.

Preparation and Financial Transparency

The foundation of any successful negotiation is thorough preparation. Start by assembling a complete financial disclosure package. This should include tax returns, income statements, bank and investment records, property appraisals, and a net-worth summary. Having these documents ready allows your attorney to model potential settlement scenarios efficiently and builds credibility with the other side.

Early and voluntary transparency can significantly reduce conflict by addressing potential suspicions and minimizing discovery disputes. This not only lowers litigation costs but also keeps discussions grounded in facts rather than assumptions, paving the way for smoother negotiations.

Focus on Interests, Not Positions

Rather than fixating on rigid demands, identify the underlying needs that drive each position. For instance, wanting to keep the house might stem from a desire to maintain your children’s school stability, stay close to a support system, or minimize disruption during a challenging time. Once these needs are clear, alternative solutions – such as delaying the sale, refinancing for a buyout, or trading home equity for other assets – can be explored.

Transform the negotiation into a collaborative process by asking open-ended questions like, "What’s most important to you about the parenting schedule?" or "Are there specific financial concerns that worry you?" Before making any offers, organize your priorities into must-haves, negotiables, and trade-offs. Shared goals, such as keeping legal fees low, preserving co-parenting relationships, or maintaining consistent routines for children, can help shift the process from adversarial to cooperative.

Communication and Emotion Management

Family law disputes often stir deep emotions, especially when children are involved. Practicing active listening – repeating the other person’s perspective before responding – can help reduce defensiveness and clear up misunderstandings. Using neutral, non-blaming language is also key. For example, saying, "When the schedule changes last minute, I feel stressed and it affects the kids", is far more productive than pointing fingers.

Start with smaller, simpler agreements to build trust before tackling tougher issues. If emotions start to run high, take a break, practice deep breathing, and refocus on the core issues at hand. Maintaining a respectful tone, even during disagreements, fosters more constructive discussions and makes it easier for both sides to compromise and find solutions.

Parenting Plans and Child-Focused Settlements

In Florida, a parenting plan is required in every case involving minor children before the court can issue a final judgment. This plan is the cornerstone of effective co-parenting after separation. It outlines how parents will share daily responsibilities, set a timesharing schedule, decide on major issues like healthcare and education, and maintain communication with their child. The court ensures that every parenting plan prioritizes the child’s best interests, evaluating factors such as each parent’s ability to meet the child’s needs, foster a positive relationship with the other parent, and provide a stable environment.

The success of any parenting plan lies in its clarity and detail. Vague terms like "reasonable visitation" or "flexible schedule" often lead to conflicts down the line. Instead, the plan should specify key details such as where the child will stay on school nights and weekends, who handles transportation for exchanges, how school-related matters like conferences will be managed, and how to resolve scheduling conflicts. A well-thought-out plan minimizes misunderstandings and ensures it works for your family’s unique situation.

Timesharing Schedules and Decision-Making Authority

A strong parenting plan includes a detailed timesharing schedule and clear decision-making guidelines. Your timesharing schedule should address every aspect of your child’s time, breaking it into categories like regular weekly routines, holiday arrangements (e.g., alternating odd/even years for Thanksgiving, winter break, and July 4th), school breaks, and summer vacations. Include exact times, locations, and tie-breaker rules for holidays to avoid confusion. Real-life factors like work hours, commute times, school start times, and the distance between homes should also be considered to create a schedule that’s practical and manageable.

Decision-making authority is another critical component. This determines who has the legal right to make major decisions about your child’s healthcare, education, religion, and other significant matters. Florida courts typically favor shared parental responsibility, meaning both parents must collaborate on major decisions. However, if joint decision-making leads to frequent deadlocks, your plan can assign one parent ultimate authority in specific areas, like medical or educational decisions. To reduce future disputes, include clear communication protocols for discussing major decisions and outline steps to follow if you can’t agree, such as mediation or appointing a tie-breaking parent for certain topics.

Aligning Parenting Plans with Child Support Obligations

Your timesharing schedule should align with Florida’s child support guidelines. These guidelines calculate support based on factors like each parent’s income, the number of overnights each parent has, health insurance and childcare costs, and other allowable credits. Since overnight counts directly influence child support amounts, your timesharing schedule must be precise and consistent with these calculations.

Make sure the plan clearly reflects overnight counts and outlines how expenses like health care, childcare, and education will be shared. Many parents also include provisions for extracurricular activities, school supplies, technology, and transportation costs related to timesharing. To avoid disagreements, specify reimbursement procedures and deadlines for submitting receipts. Collaborating with a Florida family law firm, such as Law Firm Ocala, can help ensure your child support worksheets align with your timesharing schedule. An accurate, well-drafted agreement reduces the chances of future conflicts and makes court approval smoother, allowing you to focus on co-parenting effectively.

sbb-itb-bb7ced0

Protecting Long-Term Financial Stability in Settlements

When negotiating a settlement, it’s not just about dividing property today – it’s about securing your financial future. This means addressing key areas like spousal support, retirement accounts, insurance, and updating estate plans. While Florida law outlines how assets should be divided, the details of your agreement will determine whether you’re financially secure or left exposed to potential gaps down the road. Let’s dive into the critical components of spousal support and retirement asset division.

Spousal Support and Retirement Asset Division

Florida courts consider several factors when determining alimony, such as the length of the marriage, the standard of living during the marriage, each spouse’s age and health, earning capacity, and contributions to the household (including homemaking or raising children). They also weigh the paying spouse’s ability to meet the obligation against the recipient’s documented financial need. Understanding these factors can help you negotiate realistic terms instead of relying on guesswork about what a judge might decide.

Florida recognizes various types of alimony, each serving a different purpose:

- Bridge-the-gap alimony: Designed for short-term needs, this lasts up to two years to help with transitional costs.

- Rehabilitative alimony: Provides support while a spouse completes education or training to become self-sufficient. This type typically requires a clear plan and is limited to five years.

- Durational alimony: Offers support for a set period when permanent alimony isn’t appropriate, but assistance is still necessary.

- Permanent alimony: Rarely awarded, it’s reserved for long-term marriages where one spouse cannot achieve self-sufficiency due to age, illness, or other significant factors.

When negotiating alimony, be sure to create a detailed post-divorce budget that includes housing, healthcare, transportation, insurance, and retirement savings. Structuring step-downs in alimony tied to milestones – like completing a degree or a child starting school – can provide flexibility. Keep in mind that since the 2019 Tax Cuts and Jobs Act, alimony is no longer tax-deductible for the payer or taxable for the recipient for divorces finalized after December 31, 2018. This change makes it essential to calculate after-tax impacts when determining fair amounts.

Dividing retirement accounts requires careful planning. For employer-sponsored plans like 401(k)s, 403(b)s, and pensions, a Qualified Domestic Relations Order (QDRO) is necessary to split the account without penalties. Your settlement should clearly outline the division method (percentage or fixed amount), the valuation date, how gains and losses will be handled, and who is responsible for drafting fees.

To avoid compliance issues, draft the QDRO with input from the plan administrator, ensuring it aligns with federal ERISA regulations and the specific plan’s rules. For IRAs, direct trustee-to-trustee transfers can divide assets, but you’ll need to account for tax implications and market changes. Consulting both a family law attorney and a financial advisor ensures retirement assets are divided fairly, considering their long-term value – not just their current balances.

Some couples consider trading retirement assets for other property, such as keeping the marital home instead of taking a larger share of a 401(k). While a paid-off home may seem like a safe choice, it comes with ongoing costs like property taxes, insurance, and maintenance. Plus, homes often appreciate more slowly than diversified retirement accounts, which offer tax-advantaged growth. To make an informed decision, compare the after-tax value, liquidity, and growth potential of each option. Modeling scenarios for your projected net worth and cash flow at key ages – like 55, 62, and 67 – can help you decide whether to prioritize retirement savings, housing, or a balanced mix. In many cases, downsizing to a more affordable home while securing a larger share of retirement assets and liquid savings offers better long-term stability.

Insurance and Future Financial Protection

Beyond alimony, securing your financial future also involves insurance and updating estate documents.

Health insurance is a critical consideration. If you were covered under your spouse’s plan, you’ll need to plan for coverage after the divorce. Options include COBRA, which provides up to 36 months of coverage at full premium plus a 2% fee, or exploring coverage through your employer, the Health Insurance Marketplace, or private plans. Be sure to budget for premiums, deductibles, and out-of-pocket costs. If you have chronic health conditions, you may need to negotiate higher support payments or lump-sum property distributions to offset higher insurance or medical costs.

Life insurance is another key safeguard, ensuring alimony and child support obligations are covered if the paying spouse passes away unexpectedly. The paying spouse should maintain a policy with coverage equal to the total support amount owed, naming you or your children as irrevocable beneficiaries. To ensure compliance, require annual proof of coverage and restrict any beneficiary changes without your consent.

Disability insurance protects against the risk of the paying spouse becoming unable to work due to illness or injury. Without this coverage, support obligations might be reduced or eliminated. Review existing policies to determine benefit amounts, waiting periods, and definitions of disability. If no coverage exists, consider negotiating for the paying spouse to secure a policy or adjust the settlement to account for this risk.

Once the settlement is finalized, update all beneficiary designations and account titles on financial accounts and policies. Many institutions honor the last valid designation on file, even if it conflicts with your divorce decree, potentially leaving your ex-spouse with unintended benefits. Review and update life insurance policies, retirement accounts (401(k), 403(b), IRA), payable-on-death (POD) or transfer-on-death (TOD) accounts, real estate deeds, and vehicle titles. Work with an estate planning attorney to revise or create wills, trusts, powers of attorney, and healthcare directives, ensuring your updated plans align with the settlement terms.

Law Firm Ocala specializes in navigating these financial complexities, working alongside financial and insurance professionals to address every detail. From drafting enforceable alimony agreements to preparing QDROs that meet plan requirements, their experienced counsel ensures your settlement is built for long-term financial stability – not just the immediate transition.

How Law Firm Ocala Supports Family Law Settlements

Law Firm Ocala begins every case with a thorough review of your marriage history, finances, children’s needs, and any existing court orders. This helps identify key issues like property division, timesharing, child support, and alimony. From there, the attorneys apply Florida’s equitable distribution and child support guidelines to establish realistic settlement goals. They work closely with you to outline priorities – whether it’s keeping the marital home or focusing on liquid assets – and help separate essential needs from optional preferences. This groundwork ensures every negotiation starts on solid footing.

To streamline the process, the firm provides detailed checklists and timelines for gathering essential documents, including pay stubs, tax returns, bank statements, retirement account summaries, mortgage details, and insurance policies. They also assist in creating clear, organized asset schedules to support focused and effective negotiations. For cases involving complex assets – like closely held businesses, 401(k) accounts, or pensions – Law Firm Ocala connects clients with experts such as CPAs, business valuators, and pension specialists to ensure every settlement decision is based on accurate, reliable data.

Before mediation, the team conducts preparation sessions to help you feel confident and ready. These sessions include reviewing possible negotiation scenarios and practicing key conversations through role-playing. They teach practical negotiation skills, such as focusing on shared interests rather than rigid positions, using respectful communication, and making thoughtful, incremental concessions. The firm also helps you anticipate emotional triggers and develop strategies, like taking breaks or deferring to your attorney during tense moments. Real-time evaluation tools, like worksheets, are provided to assess settlement offers based on cash flow, parenting time, and long-term security.

When it comes to finalizing agreements, Law Firm Ocala ensures settlement terms and parenting plans are written with clarity and precision. Agreements include specific details – like exact dates, dollar amounts, and clear procedures – to meet Florida court standards. The attorneys verify that all required topics are addressed, such as jurisdiction, financial disclosures, child support findings, and statutory language, minimizing the risk of future disputes or expensive legal challenges.

As a local firm, Law Firm Ocala uses its deep understanding of Marion County’s judicial preferences to craft proposals that are more likely to gain court approval. Their familiarity with local mediators allows them to recommend professionals whose styles align with your case. Additionally, their focus on family law gives them insight into common regional patterns, such as timesharing arrangements that work well with local school schedules. This combination of local knowledge and strategic planning ensures that settlements are both practical and enforceable, tailored to meet the unique needs of your family.

Conclusion

Achieving successful family law settlements in Florida requires thorough preparation, clear priorities, and realistic expectations grounded in the state’s legal framework. When both parties come to the table with complete documentation and an understanding of equitable distribution and child support guidelines, they can create agreements that are practical and sustainable. Keeping emotions in check through respectful communication, active listening, and well-timed breaks helps maintain productive discussions. Parenting plans that prioritize children, with specific timesharing schedules and decision-making guidelines, can also reduce future conflicts and provide much-needed stability for the family.

Long-term financial security is another key aspect. Structured arrangements for spousal support, division of retirement assets, and insurance provisions help both parties move forward with clarity and reduced financial risk. Negotiated agreements often provide more control, lower costs, and quicker resolutions than trials, with the added benefit of higher compliance rates since both parties contribute to the outcome.

Attorneys with a strong understanding of Florida law can evaluate settlement offers, suggest creative solutions, and prevent agreements that might be unenforceable or financially damaging. This approach ties into the detailed strategies discussed earlier. Law Firm Ocala combines legal expertise with practical negotiation skills to assist families in navigating divorce, child custody, and support matters while safeguarding assets and reducing the likelihood of future disputes.

"Law Firm Ocala cares about Florida families, and our firm will work tirelessly to get you and your family the best possible outcome for your case."

If you’re facing a divorce or need to explore settlement options, reach out to Law Firm Ocala to protect your interests and ensure a secure future for your family.

FAQs

What are the advantages of mediation over going to court in Florida family law cases?

Mediation is a popular alternative to going to court in Florida family law cases, offering several practical benefits. For starters, it’s typically quicker and less expensive than a trial, helping to resolve disputes without the hefty legal fees or long waits often tied to courtroom proceedings.

Another advantage is the cooperative atmosphere mediation creates, which is especially valuable in sensitive family matters. Instead of fueling conflict, it promotes teamwork and gives both parties more say in shaping the final agreement. This often leads to tailored solutions that better suit everyone’s needs. Plus, mediation can ease the emotional strain that comes with legal battles, offering a more positive and productive way to address family disputes.

What steps can I take to create a parenting plan that supports my child’s well-being?

When crafting a parenting plan that puts your child’s well-being first, aim for a schedule that promotes stability and allows both parents to play an active, meaningful role in their child’s life. Take into account factors like your child’s age, preferences, and any specific needs to create a plan that nurtures their emotional and physical health.

Maintaining open communication and working cooperatively with the other parent are essential for achieving a balanced plan. If you’re facing challenges or need help navigating legal requirements, reaching out to a family law attorney can offer helpful insights and ensure the plan is designed with your child’s best interests in mind.

What should I know about dividing retirement accounts during a divorce?

When splitting retirement accounts during a divorce, there are several important factors to keep in mind. Start by determining whether the account is considered marital property or separate property under the law. If the account qualifies as marital property and is subject to division, you’ll likely need a Qualified Domestic Relations Order (QDRO). This legal document allows funds to be transferred without triggering penalties.

It’s also essential to consider the tax consequences, the account’s valuation date, and how dividing the assets might affect your long-term financial plans. These details can significantly impact your financial stability after the divorce.

Because dividing retirement assets can get complicated, it’s wise to work with an experienced family law attorney. They can help you navigate Florida’s legal requirements and ensure your financial interests are protected.